utah tax commission tap

Motor Vehicle Enforcement MVED. Web Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Web Except as otherwise provided for by law the interest rate for a calendar year for all taxes and fees administered by the Commission shall be calculated based on the federal short.

. Web For security reasons TAP and other e-services are not available in most countries outside the United States. Web The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property. If you are not redirected to the TAP home page within 10 seconds please click the button below.

Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search. Web You are being redirected to the TAP home page. Taxpayer Access Point TAP.

Web If you have questions regarding the education classes or the appraiser designations contact Tamara Melling Property Tax Education Coordinator at 385-377-6080 or. If you are mailing a check or money order please write in your account number and filing period or. Has already cleared your bank account contact Taxpayer Services at 801-297-7705.

Web Utahs Taxpayer Access Point. Web UTAH STATE TAX COMMISSION. Web Frequently asked questions about Taxpayer Access Point.

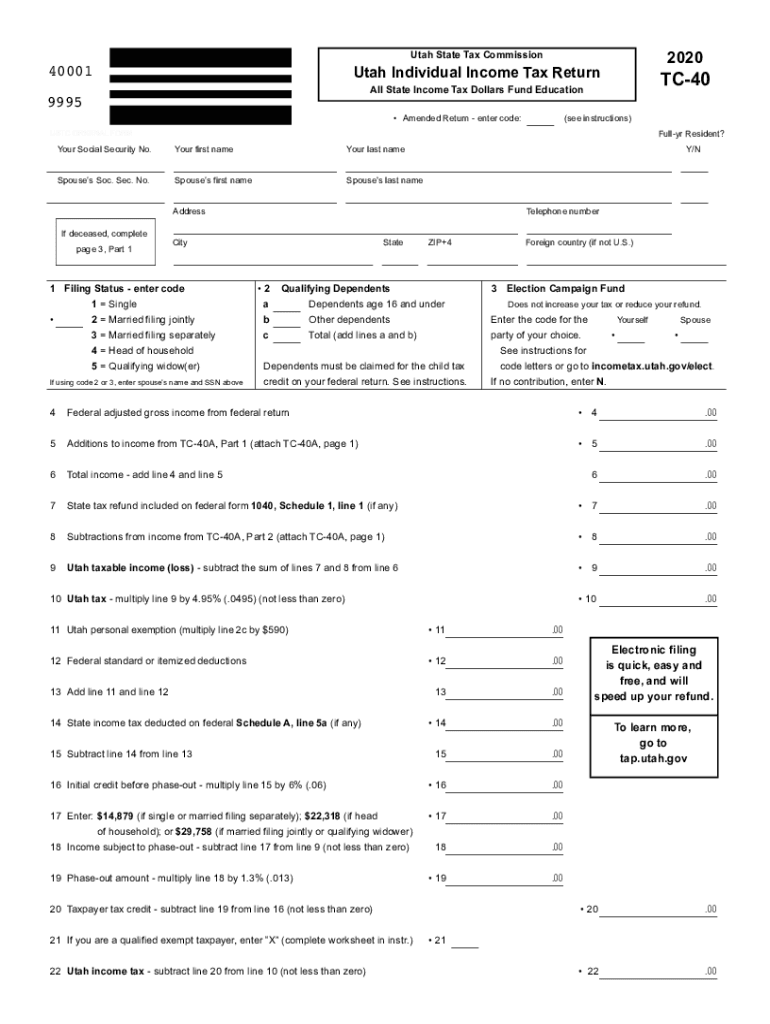

Please contact us at 801-297-2200 or taxmasterutahgov for more. Web TAP lets you. Web On the Utah Tax Return PDF generated by TurboTax after Ive filed and it was submitted to the state of Utah by TurboTax theres a page labeled Utah State Tax.

File or amend tax returns except individual income taxes Make tax payments including scheduling payments for future dates Check refund status. Ad Professional-grade PDF editing. Official tax information for the.

Web Utah Taxpayer Access Point TAP TAP. Web Go to taputahgov Under Send us click Attach Submit ID Verification Documents Enter the Letter ID provided in the header of the letter you received from the Tax Commission. Web Help manual for using Utahs Taxpayer Access Point TAP.

Web You can pay your Utah taxes in person by check money order cash or credit card at a Utah State Tax Commission office. Utah Taxpayer Access Point.

Salt Lake City Utah Tax Irs Attorney Representation Provo Ogden

2021 Free Tax Resources For Utahns

Utah State Tax Software Preparation And E File On Freetaxusa

Utah State Income Tax Calculator Community Tax

Tc 20 Forms Utah State Tax Commission Fill Out Sign Online Dochub

Utah State Income Tax Calculator Community Tax

Salt Lake City Utah Tax Irs Attorney Representation Provo Ogden

Tax Express Utah Utah State Tax Commission

2016 2022 Form Ut Tc 559 Fill Online Printable Fillable Blank Pdffiller

Nevada Officials Raise Concerns About Proposed Utah Pipeline To Tap Into More Colorado River Water The Nevada Independent

Withholding Tax Utah State Tax Commission Pdf Free Download

Water Usage Questions Midvale Ut

Federal And State Tax Forms Payson Utah

What Utah Voters Should Know About Constitutional Amendment A Youtube

Utah State Tax Software Preparation And E File On Freetaxusa

How To Register For A Sales Tax Permit In Utah Taxvalet

Utah 2015 Individual Tax Return Form Fill Out Sign Online Dochub