unemployment income tax refund calculator

Use the 2019 forms below to prepare your 2019 Return. This provides an income tax refund to families that may have little or no income tax withheld from their paychecks.

How And When Should You Pay Your Advance Taxes Income Tax Return Tax Income Tax

Fastest tax refund with e-file and direct deposit.

. The new rates are 10 12 22 24 32 35 and 37They will phase out in eight years. You have until April 15 2023 to claim your 2019 tax refund. We provide the IRS with a copy of this information.

Learn More About State Tax Returns State Extensions and State Amendments. 2021 Tax Calculator to Estimate Your 2022 Tax Refund. The IRS will receive a copy of your Form 1099-G as well so it will know how much you received.

These forms will open in an online editor to be filled in before they can be printed and mailed. Refundable credits are included in the calculation only to the point where your tax liability would be zero and any withheld tax would be refunded to you. By doing so you may receive a refund for some or.

We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. It is mainly intended for residents of the US. It is not your tax refund.

Changes the Seven Tax Rates. This is because the outstanding taxes you owe to the IRS always needs to be paid first. Estimate your tax refund using TaxActs free tax calculator.

Qualified children for the EITC must be dependants under age 19 full-time dependant students under age 24 or fully disabled children of any age. At tax time TurboTax Premier will guide you through your investment transactions allow you to automatically import up to 10000 stock transactions at once and figure out your gains and losses. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up.

Qualified children for the EITC must be dependants under age 19 full-time dependant students under age 24 or fully disabled children of any age. Before any other federal or state agency can garnish your tax refund you must be current on your federal income tax payments. For example if you fall into the 25 tax bracket a 1000 deduction saves you 250.

Use this 1040 tax calculator to help estimate your tax bill for the current tax years rates and rules. Total unemployment compensation. Form 1099-G Income Tax Statement showing the amount of Unemployment Insurance benefits paid and amount of federal income tax withheld will be in January following the calendar year in which you received benefits.

Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe. You have now Successfully Completed Your 2021 IRS Income Tax Return Calculation. The Earned Income Tax Credit or EITC is a refundable tax credit for lower to middle income working families that is largely based on the number of qualifying children in your household.

You can also connect live via one way video to a TurboTax Live Premier tax expert with an average 12 years experience to get your questions answered along the way or. Before you FileIT your 2019 Return use our 2019 Tax Calculator to estimate your 2019 Tax Refund or Taxes Owed. Deductions lower your taxable income by the percentage of your highest federal income tax bracket.

Deduct the amount of tax paid from the tax calculation to provide an illustration of your 202223 tax refund. If you make 70000 a year living in the region of New York USA you will be taxed 12312. You dont need to include a copy of the form with your income tax return.

202223 Tax Refund Calculator. This calculator is for 2022 Tax Returns due in 2023. Tax Reform Changes for Tax Years 2018.

Estimated Taxes Owed. Tax refund time frames will vary. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

The Earned Income Tax Credit or EITC is a refundable tax credit for lower to middle income working families that is largely based on the number of qualifying children in your household. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Deadline for employees who earned more than 20 in tip income in December to report this income to their employers on Form 4070.

Your average tax rate is 1198 and your marginal tax rate is 22. Start a New 2021 Tax Return. In some cases the EIC can be greater than the total income taxes owed for the year.

However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method. Your employer has until Jan. And is based on the tax brackets of 2021 and 2022.

How Taxes on Unemployment Benefits Work. You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the unemployment income you received in 2021. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets.

The standard deduction amount is increased from 6350 to 12000 for Single and Married Filing Separately filers 12700 to 24000 for Married Filing Jointly and Widow filers. Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate. No the refund amount on the calculator is a refund of withheld tax only.

Check the IRS Tax Return status of your 2021 Return. This marginal tax rate means that. As you make progress the taxes you owe or the refund you can expect to receive will be calculated and displayed on each page.

Fastest refund possible. The premium tax credit caps below are an example see the premium tax credit caps for 2020 to see the most recent premium tax credit caps. The IRS issues more than 9 out of 10 refunds in less than 21 days.

If you used e-Collect and one the IRS and State agency have released your Refund money check the e-Collect Refund Status. This is an optional tax refund-related loan from MetaBank NA. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022.

The caps are printed each year on form 8962 at tax time and earlier in the year in federal register. See how income withholdings deductions and credits impact your tax refund or balance due. Income Level Premium as a Percent of Income these amounts adjust upward slightly each year.

Enter your tax information to the best of your knowledge. Fastest federal tax refund with e-file and direct deposit. Estimate the areas of your tax return where needed.

Fastest Refund Possible. 31 to send you your W-2 form reporting your 2021. See Important IRS Federal Tax Day Deadlines and Due Dates and State Income Tax Day Deadlines and Due Dates.

Doubles the Standard Deduction. Get your tax refund up to 5 days early. Yes No Self-Employment Form 1099-NEC or 1099-MISC.

Deadline to pay the fourth-quarter estimated tax payment for tax year 2021. January to March. Looking for a quick snapshot tax illustration and example of how to calculate your.

Tax refund time frames will vary. For example if you owe taxes for a prior year but expect a tax refund in the current year the federal government doesnt view this as an. Loans are offered in amounts of 250 500 750 1250 or 3500.

The full amount of your benefits should appear in box 1 of the form. File a 2019 Return Today. The IRS issues more than 9 out of 10 refunds in less than 21 days.

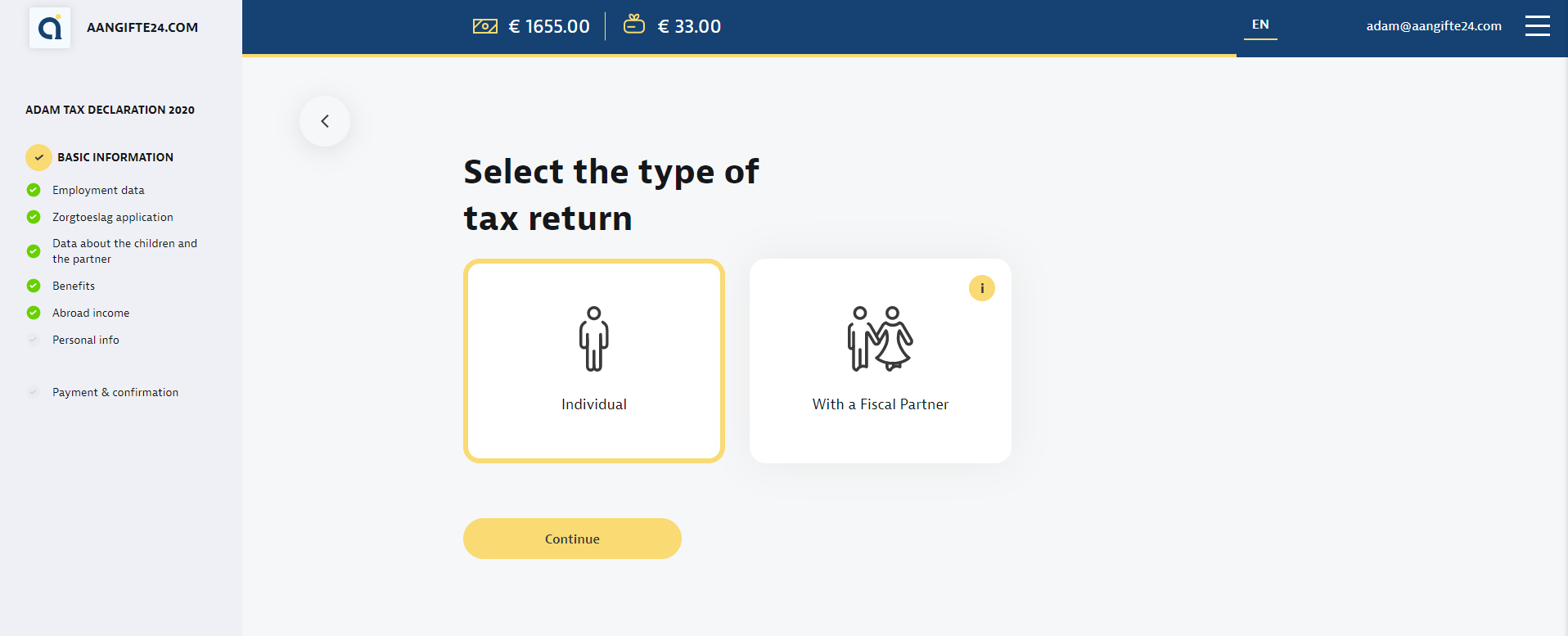

Netherlands Income Tax Calculator Online Aangifte24

Online Income Tax Calculator Deals 53 Off Www Quadrantkindercentra Nl

Bankruptcy During Tax Time Can You Keep Your Refund The Law Offices Of Kenneth P Carp

Income Tax In Germany For Expat Employees Expatica

Tax Tips Bookkeeping Services Irs Taxes Tax Preparation

Federal Tax Calculator 2019 Deals 58 Off Www Quadrantkindercentra Nl

Tax Calculator For Income Unemployment Taxes Estimate

Irs Tax Calculator Shop 52 Off Www Quadrantkindercentra Nl

Irs Tax Calculator Shop 52 Off Www Quadrantkindercentra Nl

Vat Registration Accounting Tax Consulting Tax

Netherlands Income Tax Calculator Online Aangifte24

Online Income Tax Calculator Deals 53 Off Www Quadrantkindercentra Nl

This Online Calculator Will Show You How Much To Expect Iheartradio Tax Deductions Successful Home Business Finances Money

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Online Income Tax Calculator Deals 53 Off Www Quadrantkindercentra Nl

Work Tax Calculator Online 50 Off Www Quadrantkindercentra Nl